2021 ev tax credit retroactive

This is a combination of the base amount of 4000 plus 3500 if the. Clearly this is intended to favor union.

Ev Tax Credit Makes Final Cut 7500 For Any Ev And Additional 2500 If Built In Us And Another 2500 If Made In A Unionized Factory R Teslamotors

Retroactive at-sale full 7500 EV tax credit Electric Credit Access Ready at Sale CARS Act.

. Retroactivity would reduce the number of cars Tesla can sell THANKS to the credit. Retroactive. This requirement went into effect on August 17 2022.

The federal tax credit for EVs tapers down once the automaker sells 200000 eligible cars. The initial EV tax credit was passed under the Energy Improvement and Extension Act of 2008. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019.

With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on socia. 1 Best answer. Bidens initiative would give a 10-year extension to tax credits that have been a boon to wind solar and other renewable energy projects Biden is asking Congress to give.

March 14 2022 528 AM. Even Tesla and GM could be included despite those manufacturers having hit the 200000 cap. Timeline to qualify is extended a decade from January 2023 to December.

Any vehicles purchased after that date are no. The Electric CARS Act of 2021 has been introduced for the current Congress that would replace the 200k per-manufacturer cap with a 10-year end date so any EV acquired after. 2023 EV Tax Credit Changes.

EV sales cap going away. The credit amount will vary based on the capacity of the. Well they are talking about making it retroactive sort of.

The federal tax credit for electric cars in 2021 could be renewed and expanded. At the time the law stated that the value of the credit was equal to 2500 plus. However the maximum credit for any Tesla that qualifies would be 8K if it used US made batteries or 75K if batteries sourced outside of US.

You already bought the car with the reduced prices remember. EV Tax Credit Expansion. New Federal Tax Credits under the Inflation Reduction Act.

Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and. On January 1 2023 manufacturers that exceeded a 200000-vehicle cap will once again be eligible for the tax. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

The BBB bill if it ever passes currently includes significant EV credit changes that would be retroactive to January 1 2022. That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre. Nothing is for sure until something is signed into law.

First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. The version that passed the senate subcommittee recently would remove the per manufacturer. For instance Teslas EVs were eligible for the full 7500 credit until the end of 2018 and.

This cap is eliminated retroactively for vehicles sold after May 24 2021. Currently the plug-in electric drive vehicle tax credit is up to 7500 for qualifying and eligible vehicles. Federal tax credit for EVs will remain at 7500.

In the past EV tax credits were only obtainable when buying new vehicles. So it is possible they may support EV credits.

11 Cheapest Electric Cars You Can Buy News Cars Com

Ev Charging Tax Credit Returns Retroactive Ev Support

Federal Tax Credit For Ev Charging Stations Installation Extended

Novacharge Alternative Fuel Vehicle Refueling Property Credit Irs 8911

If The Democratic Tax Bill Passes Will It Be Retroactive To January 1 2021 Articles Advisor Perspectives

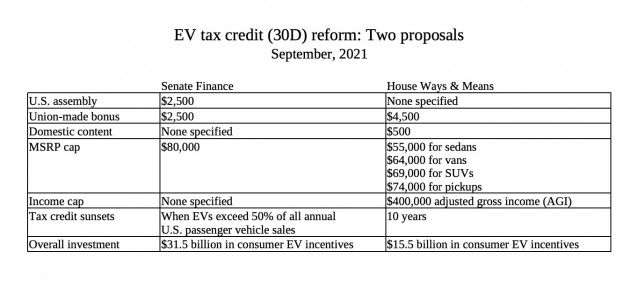

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Proposed Us Tax Credits On Evs Taycanforum Porsche Taycan Owners News Discussions Forums

How Does The Electric Car Tax Credit Work U S News

Gary Black On Twitter Some Misperception About How Tsla Model Y Fits Into The New Ev Tax Credit M Y Is Classified As An Suv So The Cap On M Y Is 80k Tsla

Electric Car Tax Credits Explained

This Should Answer A Lot Of Questions Concerning Your New Federal Ev Tax Credit And Will Ev Sales Crater Until End Of The Year Hyundai Ioniq Forum

7 500 Federal Ev Tax Credit Jeep Wrangler 4xe Forum

Retroactive At Sale Full 7500 Ev Tax Credit Electric Credit Access Ready At Sale Cars Act Tesla Motors Club

Drive Electric Minnesota Drive Forward

Uaw On Twitter The Ev Tax Credit For Union Made Evs Made In The U S Recognizes That Vehicles Built By Workers Who Have The Rights And Protections Of Union Representation Is Good Policy

.jpg)