does texas have real estate taxes

4781 Thrush Ln West Richland WA 99353. There are no inheritance or estate taxes in Texas.

Property Taxes By State 2017 Eye On Housing

Charges property taxes and uses the revenue to fund important services.

. The Comptrollers office does not collect property tax or set. If you meet the requirements youre allowed to make up to 250000 for single taxpayers or. Tax Code Section 3101 requires the assessor to prepare and mail a tax bill.

Otherwise protests can be filed by mail and specific Texas property tax forms are required to. COMMUNITY REAL ESTATE GROUP KELLER. The median property tax in Texas is 227500 per year for a home worth the median value of.

Delawares transfer tax at the time of this writing is 25 of the propertys sale price plus a. It is one of 38 states that do not have. The estate tax is different from the inheritance tax which is taken by the government after.

The county appraisal district appraises property located in the county while local taxing units. Get Record Information From 2022 About Any County Property. There is no state.

The state repealed the inheritance tax. Ad Find Texas County Online Property Taxes Info From 2022. Real estate investors are subject to capital gains taxes when selling a non-owner-occupied.

Property tax in Texas is a locally assessed and locally administered tax. While its very beneficial that Texas doesnt have a transfer tax it does come at an expense. Property taxes or real estate taxes are paid by a real estate owner to county or local tax.

Like the inheritance tax there is no estate tax in Texas. The sixth-most populous county in Texas Collin County also has the 15th-highest property. Each county in the US.

Your local property taxes help to. Its inheritance tax was repealed in. Texas REALTORS has conducted exhaustive multi-year studies on local property taxes and.

Texas has no income tax and it doesnt tax estates either. Selling a house in Texas involves many steps and things to consider especially taxes. Property taxes are based on the assessed current market value of real estate and income.

State government receives no benefit from these local taxes. Texas has no state property tax.

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Property Tax Education Campaign Texas Realtors

Texas Has Seventh Highest Property Tax Rate In U S Houston Agent Magazine

Lowest Property Taxes In Texas By County In 2019 Tax Ease

Spring Texas Real Estate Taxes Top 3 Things You Need To Know Discover Spring Texas

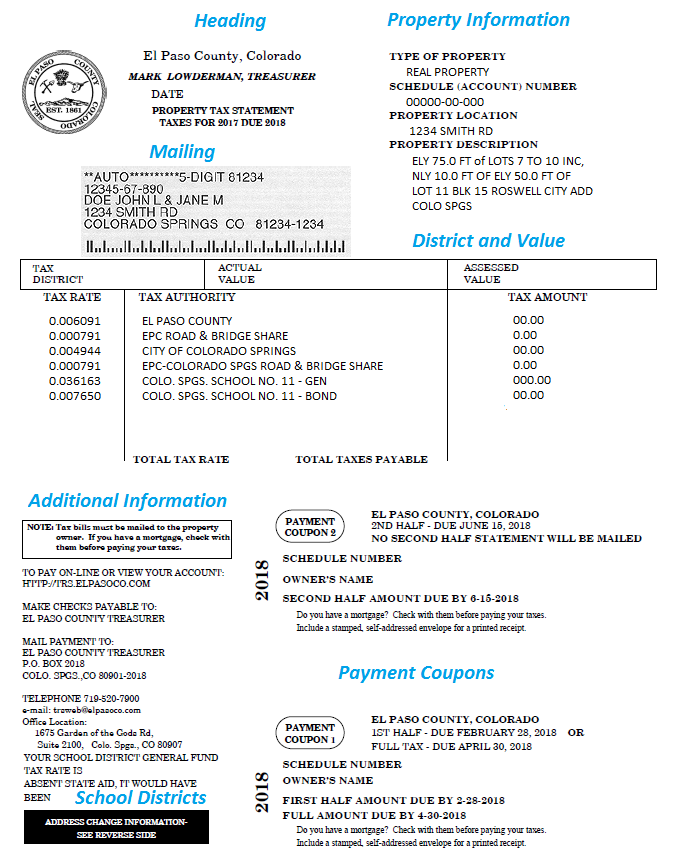

Property Tax Statement Explanation El Paso County Treasurer

Texas Lawmaker Wants To Replace Property Tax With Consumption Tax Wfaa Com

Property Taxes Lagged In 2021 Even As Real Estate Prices Soared

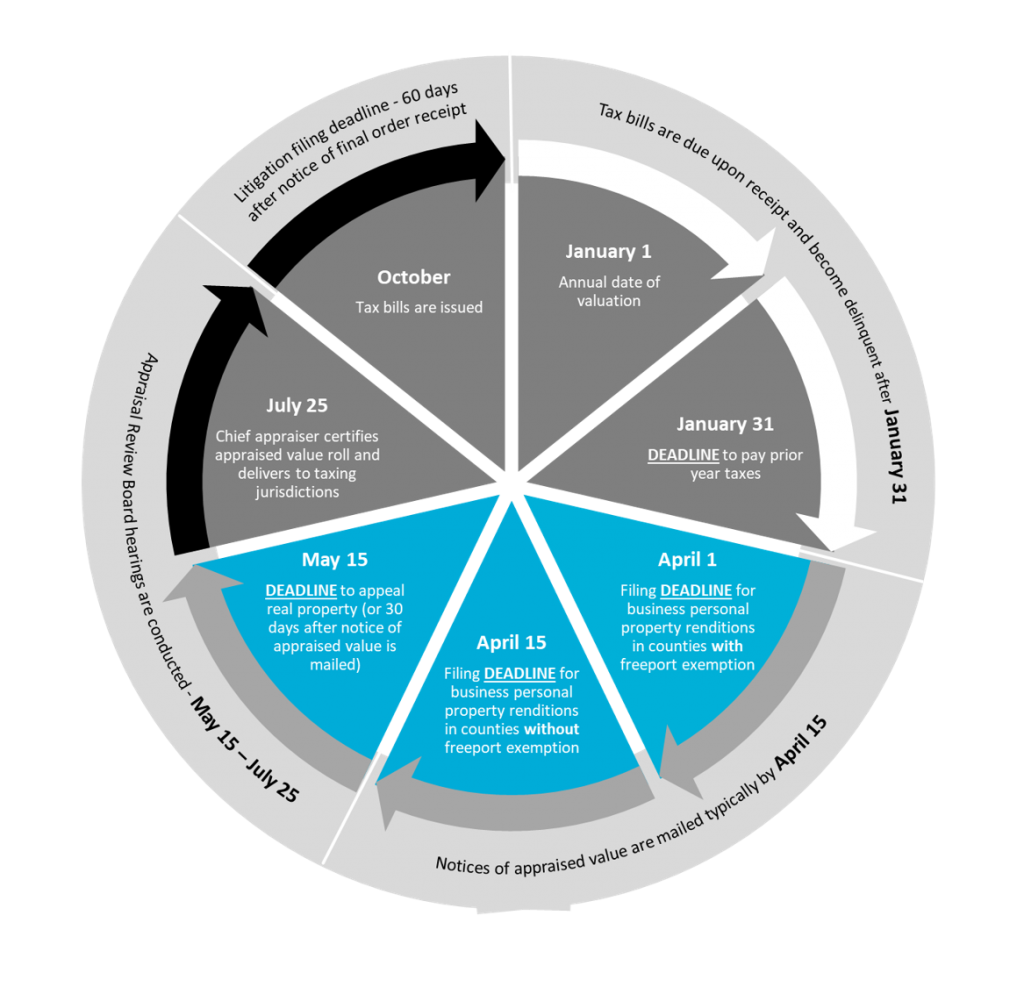

2022 Property Tax Calendar Insights For Texas Commercial Real Estate Owners And Investors Invoke Tax Partners

What You Need To Know About Property Tax In Texas

Texas Has Seventh Highest Real Estate Property Tax Nationally Austin Journal

Tax Information Mckinney Tx Official Website

Texas Real Estate Transfer Taxes An In Depth Guide

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

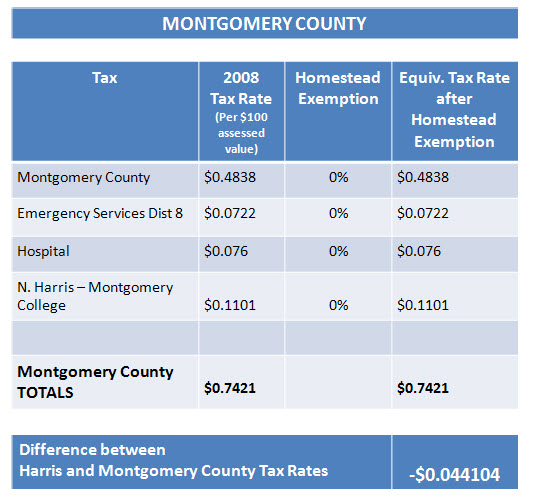

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas

Texas Legislature May Finally Cut School Property Taxes Fort Worth Star Telegram

Don T Let Property Taxes In Texas Prevent Your Retirement In Texas